Cancel Premium for PMJJBY and PMSBY | SBI PMJJBY PMSBY Cancellation 2025

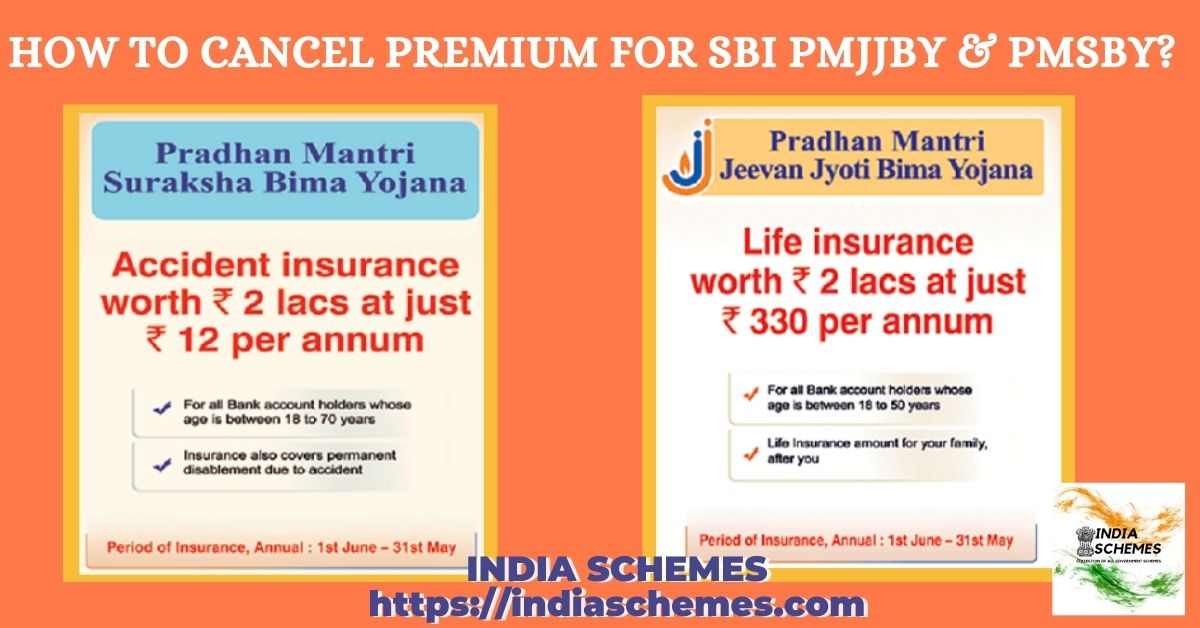

PMJJBY full form is Pradhan Mantri Jeevan Jyoti Bima Yojana. It is a government life insurance scheme that gives money to the family if the insured person dies.

PMSBY full form is Pradhan Mantri Suraksha Bima Yojana. It is a government accident insurance scheme that gives money in case of death or disability due to an accident.

Table of Contents

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

PMSBY Scheme is available for people in the age group 18 to 70 years having a bank account; these people need to give their permission to join or enable auto-debit on or before 31st May for the coverage period stretching from 1st June to 31st May. This is an annual renewal scheme. An Aadhaar card will be used as the primary KYC for the bank account. It is advised to keep a record of all transactions related to the scheme for future reference.

The risk coverage under the PMSBY scheme

- Rs 2 lakh for accidental death or full disability.

- Rs. 1 lakh for partial disability due to accident.

The premium of Rs. 12 per annum will be deducted from the bank account through the ‘auto-debit facility in one installment every year. This scheme is offered by Public Sector General Insurance Companies or any other similar General Insurance Company willing to offer the product with similar terms, with necessary approvals and tie-up with banks for this purpose.

Pradhan Mantri Jeevan Jyoti Bima Yojana(PMJJBY)

The PMJJBY scheme is available for people in the age group 18 to 50 years with an active bank account. These people need to give their permission to join/enable auto-debit. An Aadhaar card will be used as the primary KYC for the bank account. The life cover will be Rs. 2 lakhs for the one-year period stretching from 1st June to 31st May. This will be renewable.

The Risk coverage under the PMJJBY scheme is –

- Rs. 2 Lakh in case of death of the insured person, due to any reason.

The premium will be Rs. 330 per annum, and this will be auto-debited in one installment from the bank account. The person will have a choice to subscribe under the scheme on or before 31st May of every year coverage period. The scheme will be offered by Life Insurance Corporation and all other life insurance companies that are willing to offer the product on similar terms, with necessary approvals and a tie-up with banks for this purpose.

Update on PMJJBY & PMSBY

The government had revised the Premium for insurance schemes from June 1, 2022 – Check new rates

✅ Revision of premium rates of Pradhan Mantri Jeevan Jyoti Bima Yojana #PMJJBY and Pradhan Mantri Suraksha Bima Yojana #PMSBY w.e.f. 01.06.2022

✅ 1st ever revision in the premium rates since inception of both schemes in 2015, 7 years ago

Read more ➡️ https://t.co/jwYDKXEAFs pic.twitter.com/YMlhVZstAw

— Ministry of Finance (@FinMinIndia) May 31, 2022

The government had revised premium rates of PMJJBY and PMSBY ( Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana, respectively).

The revised rates are given below-

- For PMJJBY, the premium has been increased from Rs. 330 to Rs. 436

- For PMSBY, the premium increase is from Rs. 12 to Rs. 20.

The premium rates have been revised by considering the premium of Rs 1.25 per day for both schemes.

How to cancel Premium for PMJJBY & PMSBY?

1st Method – Easy SBI PMJJBY PMSBY Cancellation

Application Format to Cancel PMJJBY and PMSBY in English

If you wish to discontinue your enrollment in the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY), you can submit a written application to your bank for a PMJJBY and PMSBY cancellation letter in English :

To

The Branch Manager

[Your Bank’s Name]

[Branch Address]Date: [DD/MM/YYYY]

Subject: Request for Cancellation of PMJJBY and PMSBY

Respected Sir/Madam,

I am [Your Full Name], an account holder at your branch with account number [Your Account Number]. I had enrolled in the following government insurance schemes:

PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana)

PMSBY (Pradhan Mantri Suraksha Bima Yojana)

I would like to request the cancellation of my participation in both the above schemes with immediate effect. Kindly stop any future premium deductions from my account.

My details are as follows:

Account Holder Name: [Your Name]

Account Number: [Your Account Number]

Registered Mobile Number: [Your Mobile Number]

Date of Birth: [Your Date of Birth]

I request that you take the necessary action and confirm the cancellation.

Thank you.

Sincerely,

[Your Signature]

[Your Name]

[Contact Number]

पीएमजेजेबीवाई और पीएमएसबीवाई योजना रद्द करने के लिए आवेदन पत्र प्रारूप

यदि आप प्रधानमंत्री जीवन ज्योति बीमा योजना (PMJJBY) और प्रधानमंत्री सुरक्षा बीमा योजना (PMSBY) से नामांकन रद्द करना चाहते हैं, तो नीचे दिया गया आवेदन पत्र बैंक में जमा करके प्रक्रिया पूरी कर सकते हैं:

प्रति

शाखा प्रबंधक

[बैंक का नाम]

[शाखा का पता]दिनांक: [DD/MM/YYYY]

विषय: पीएमजेजेबीवाई और पीएमएसबीवाई योजना रद्द करने हेतु आवेदन

महोदय/महोदया,

मैं [आपका पूरा नाम], आपके बैंक का एक खाताधारक हूं, जिसका खाता संख्या [आपका खाता नंबर] है। मैंने निम्नलिखित सरकारी बीमा योजनाओं में नामांकन कराया था:

प्रधानमंत्री जीवन ज्योति बीमा योजना (PMJJBY)

प्रधानमंत्री सुरक्षा बीमा योजना (PMSBY)

मैं अब इन दोनों योजनाओं से नाम हटवाना चाहता/चाहती हूं। कृपया मेरा नामांकन रद्द करें और भविष्य में मेरे खाते से कोई भी प्रीमियम कटौती न करें।

मेरी विवरण निम्नलिखित है:

खाताधारक का नाम: [आपका नाम]

खाता संख्या: [आपका खाता नंबर]

पंजीकृत मोबाइल नंबर: [आपका मोबाइल नंबर]

जन्म तिथि: [आपकी जन्म तिथि]

कृपया मेरी अनुरोध पर शीघ्र कार्रवाई करें और रद्दीकरण की पुष्टि प्रदान करें।

धन्यवाद।

भवदीय,

[आपका हस्ताक्षर]

[आपका नाम]

[संपर्क नंबर]

Nothing

I want closed PMJJBY & PMSBY and I am not interested this policy.

Hello. I’m a journalist and am doing research for a story on how banks are forcibly activating these policies in our account. Request you to contact me at 9742772939.

My Son is an NRI , On my request Bank also sent mail for cancellation, still it is being debited.

They didnt tell at time opening bank account and give 3 4 document to fill and and we fill all of them without reading it properly And they also didn’t tell about any charges of policy.

I am also forced to do that

Please. Sir, Pmjjby cancel

I’m a SBI savings Account Holder

Theh have compulsory policy of adding SBI life insurance of premium 1000, which they say will not be auto renewed in next year.

They add PMJJBY (auto renewal charge Rs. 436 )and not ask you about this, not even give you information about this. You will know when your money is deducted.

They add PMSBY and you will get to know when amout is debited from savings account.

Yes please raise this issue thay activate this policy on my behalf without any consent whe i went to cancel they didn’t help me.

Even they mentioned my nominees will get benefits for this my mother and father.they passed away in 2013 .help me

I want closed pmjjby &pmsby and i not interested this policy

Iam not interest PMJJBY.

I want closed PMJJBY & PMSBY and I am not interested this policy.

Meri policu ko cencel krna hai please usko band krne ka Gained kro please

Yes. I want closed pmjjby i not

Interested this policy

SBI account see auto debit pmjjby band karne ke vishay me

Name vikash Kumar mahatha

Account number 35836009414

Branch-Panchdewari

Pin-841441

PMJJBY insurance policy canel police

I want closed PMJJBY & PMSBY and I am not interested this policy.

Dear Reader,

Thank you for showing interest in our post. There is only one way to cancel the services that is you have to visit bank.

Please keep visiting India Schemes for more updates.

How to cancel

PMJJBY CANCEL CHAHIYE

PMJJBY CANCEL CHAHIYE

बिना पूछे क्यों पैसे काटे मेरे आपने

मुझे इंटरेस्ट नहीं है मेरा ऑलरेडी बीमा हो रहा है

I want closed PMJJBY & PMSBY

And I am not interested this

Policy

I want closed PMJJBY & PMSBY

And i am not interested this

Policy

I want closed PMJJBY & PMSBY and I am not interested this policy

My insurance policy cancel

I want closed PMJJBY & PMSBY and I am not interested this policy understand

I am now 53 years old this scheme only age of 50, unnecerraly auto debit my account.

I want closed the policy i am not interested

I want closed PMJJBY nd PMSBY and I am not interested this policy plz deactivate kor dijiaga.

sir plzz cancel this PMSBY AND PMJJBY

Dear Reader,

Thank you for showing interest in our post. There is only two ways in which you can stop this deduction which is written in the post.

Please keep visiting India Schemes for more updates.

I want closed the policy i am not interested

Please closed my pmjjby policy.becuse iam a very poor person so kindly close the account

Dear Reader,

Thank you for showing interest in our post. There is only two ways which you can stop this deduction which is written in the post.

Please keep visiting India Schemes for more updates.

I want closed PMJJBY and PMSBY and I am not interested this policy

Dear Reader,

Thank you for showing interest in our post. There is only two ways in which you can top the deduction which is written in the post.

Please keep visiting India Schemes for more updates.

Please cancel Pradhan mantri jeevana yojan

I want closed pmjjby i am not interested refund my money rs 436

Dear Reader,

Thank you for showing interest in our post. There is only two ways you can stop the deductions which is written in the post.

Please keep visiting India Schemes for more updates.

I didn’t active pmjjby but this year on may they have debited rs 330 and again on June they ve debited Rs436 through sbi account so please deactivate my pmjjby insurance and return my money by the earliest. Thanks.

Dear Reader,

Thank you for showing interest in our post. Actually this deduction is done by your bank so to cancel this policy and deduction you need to visit bank by yourself.

Please keep visiting India Schemes for more updates.

I’m not interested on your policy I consider to return my money🙏🙏🙏🙏

Dear Reader,

Thank you for showing interest in our post. Actually you need to visit bank to cancel this services. There is only two ways which is written in the post.

Please keep visiting India Schemes for more updates.

Sar Mera PMG jawai wala policy band kar dijiye aur mera Paisa return kar dijiye thank u

I want closed PMJJBY & PMSBY and I am not interested this policy.

Dear Reader,

Thank you for showing interest in our post. There is only one way that is you have to visit bank.

Please keep visiting India Schemes for more updates.

I want closed PMJJBY & PMSBY and I am not interested this policy

Dear Reader,

Thank you for showing interest in our post. There is only one ways that is to visit bank.

Please keep visiting India Schemes for more updates.

I don’t want such scheme or policy. So i want to cancel the policy plzz help me to get the policy cancel it’s a request

Dear Reader,

Thank you for showing interest in our post. There is only way to cancel the post is you have to visit bank.

Please keep visiting India Schemes for more updates.

Need a help.. i want to to stop this through online …plz help

Dear Reader,

Thank you for showing interest in our post. Actually there is no way to stop this services through online platform. There is only two ways which is written in the post.

Please keep visiting India Schemes for more updates.

I want to close PMJJBY and PMSBY , policies.i am not intrested in both policies.

Weast insurance in pmjjby

My dad death time not claim in pmjjby scheme

Weast insurance in pmjjby

My dad death time not claim in pmjjby scheme

I want to close my PMJJBY scheme SBI life insurance.

I want to close PMJJBY AND PMSBY POLICIES.i am not interested please deactivate auto debit

I am also not interested in PMSBY plz deactivate this from my bank account i am not interested in this policies

Please closed my pmjjby policy. because i am a very poor person so kindly close the account

Though we go to bank and request them to cancel this pmjjby/pmsby policy, they aren’t responding good. Instead they just say that, the site for cancelling this policy is not working.

Mu PMSBY rs 20 closed this i have interested this policy i request you warna mera sbi account closed kar do ji