Nearly every student wants to get higher education but many students are not able to fulfill their dream due to poor financial conditions. The government initiated various schemes to ensure the availability of higher education among all the students. Today we will tell you about a scheme launched by the Government of West Bengal called the West Bengal Student Credit Card Scheme.

Students will be provided loans for higher education through this scheme. By reading this article you will get all the necessary information about this scheme for e.g What is West Bengal Student Credit Card? Its purpose, benefits, eligibility criteria, the application process, etc. So read this article very carefully till the end.

Table of Contents

West Bengal Student Credit Card Scheme

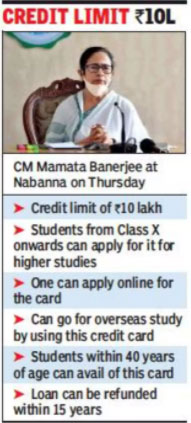

West Bengal Chief Minister Mamata Banerjee has launched the West Bengal Student Credit Card Scheme. The decision to launch this scheme was taken in the state cabinet meeting held on 24 June 2021. Through this scheme students of class 10 or above can take a loan up to Rs 10 lakh for higher education. They will get this loan at a very low interest rate. A credit card will be provided to the students to avail of this loan.

Students can withdraw the loan amount with this credit card. All those students who are residing in West Bengal for the last 10 years can take advantage of this scheme. Loans can be taken under this scheme for undergraduate, postgraduate, doctoral, and postdoctoral studies in India or abroad.

Highlights Of West Bengal Student Credit Card

| Name Of The Scheme | West Bengal Student Credit Card |

| Launched By | Government Of West Bengal |

| Beneficiary | Students Of West Bengal |

| Objective | To Provide Loans For Higher Education |

| Official Website | To Be Launched For Click Here |

| Amount Of Loan | Up to Rs 10 Lakh |

| Repayment Period | 15 Years After Getting Job |

Student Credit Card Scheme Launched

The West Bengal Government has launched the West Bengal student credit card scheme on 30th June 2021. This scheme has been launched to provide loans for the higher education of the students. Meetings are being held with colleges to demonstrate the plan of action for this scheme.

The Higher Education Department will soon issue an official order to start the West Bengal Student Credit Card Scheme. Ten lakh rupees is the maximum limit of this loan. This loan can be used for pursuing studies in India and abroad. This scheme was a part of the election manifesto made by the West Bengal Chief Minister Mamata Banerjee.

Bihar Student Credit Card Scheme

Interest Rate Under West Bengal Student Credit Card Scheme

Students studying in class 10th and above can take advantage of this scheme. They can avail a hassle-free and collateral-free loan. This loan will be provided without any security in a tangible or intangible form.15 years is the repayment period for this loan. The Higher Education Department will send the student’s application to the bank. Students can use the loan amount for institutional and non-institutional expenses like rent, hostel fees, projects, etc.

Repayment Period Of West Bengal Student Credit Card

The plan was a part of the election manifesto of the Trinamool Congress. The benefit of this scheme can be availed by the students up to the age of 40 years. It is also worth noting that the process of applying for the loan will be simplified so that the students can avail the loan easily. Students have to repay the loan within 15 years after getting the job. They can also apply for a credit card online. On 30th June 2021, the West Bengal Student Credit Card scheme will be launched officially.

I am delighted to announce that GoWB has launched the #StudentCreditCard today.

To make the youth of Bengal self-reliant, the Scheme shall provide a loan of up to ₹10 Lakh with an annual simple interest. (1/2)

— Mamata Banerjee (@MamataOfficial) June 30, 2021

Moreover, the Scheme will benefit all students residing in West Bengal who are enrolled in Higher Educational Institutions & Competitive Examinations Coaching Centres.

GoWB is working relentlessly to achieve all the promises of my 10 Ongikars. (2/2)

— Mamata Banerjee (@MamataOfficial) June 30, 2021

Objective Of Student Credit Card Scheme

The main objective of this scheme is to provide loans to students who are in class 10 or above. Up to Rs, 10 lakh will be provided to students for their Higher Education without any financial burden. Now each student of West Bengal will be able to get higher education. This scheme will also reduce the unemployment rate among the residents of West Bengal.

Features & Benefits Of Student Credit Card Scheme

- West Bengal Chief Minister Mamata Banerjee has launched West Bengal Student Credit Card Scheme

- Through this Scheme Rs, 10 lakh will be provided to the students for their studies.

- Students studying in class 10th or above can take advantage of this scheme. Credit Card can also be availed for undergraduate, postgraduate, doctoral, and postdoctoral studies in India and abroad.

- The loan will be available at a very low interest rate.

- Students can withdraw the amount of a loan through a credit card.

- All those students who are living in West Bengal for the last 10 years can benefit from this scheme.

- This panorama was a part of the election manifesto.

- The benefit of this scheme can be availed till the age of 40 years.

- Students have to repay the amount of the loan within 15 years after getting the job.

Eligibility Criteria

- The applicant student should be a permanent resident of West Bengal

- Applicant student must be living in West Bengal state for a period of at least 10 years

- The upper age limits 40 years to apply for this scheme.

Required Documents

- Aadhar card

- Residence certificate

- Age proof

- Ration card

- Income certificate

- Bank account details

- Mobile number

- Passport size photograph

How To Apply For Student Credit Card West Bengal

If you want to apply for a student credit card scheme then you need to follow the easy steps given below:-

- Firstly you need to visit any State cooperative Bank or its affiliated Central cooperative bank/district Central cooperative bank/public or private sector bank

- Here you can ask the concerned person for the West Bengal student credit card scheme application form.

- Now you need to fill in all the required details in this application form such as –

- your name,

- mobile number,

- email id, etc

- Attach all the required documents.

- Submit this application form to the same bank from where you have received it.

- Now the bank authorities will give you a reference number with this reference number, you can track the status of your application.

Related Posts-

- Bihar Student Credit Card Scheme

- National Scholarship Portal

- PFMS Scholarship

- Banglarbhumi

- Swasthya Sathi Scheme

- West Bengal Digital Ration Card